|

Spring Home Sales

Start Strong

Key

Forecast Is Revised Upward, Despite Pockets of

Weakness; Rebounds in the O.C. and Boston

By

RUTH SIMON

Staff Reporter of THE WALL STREET JOURNAL

April 19, 2005; Page D1

After a multiyear

real-estate boom that has raised concerns about a

housing bubble in a number of markets, economists

and homeowners are closely watching this year's

spring selling season for any signs of a slowdown.

So far, there aren't

many of them.

Spring tends to be the

hottest selling season, with families looking to

move well before the start of the next school year.

And sales are getting off to a strong start in many

parts of the country.

In a revised forecast,

the National Association of Realtors now says it

expects sales of existing single-family homes to

fall 2.4% to 6.62 million for the full year, which

still would be the second-highest level on record.

That is better than the 5% slide the Realtors group

predicted at the start of the year.

One reason: The

much-anticipated increase in long-term mortgage

rates has yet to materialize. Weak economic news has

helped push rates on 30-year fixed-rate mortgages

below 6%, from a recent high of 6.17%, according to

HSH Associates, providing a nudge to buyers fearful

that rates will shoot up again.

The brisk start to the

season comes as concerns about the housing market

have been escalating. In a speech yesterday, Federal

Reserve Governor Susan Bies said, "We are beginning

to see signs that housing prices may be reaching a

peak in some markets." She cited the growing share

of homes purchased by investors, and the large

number of borrowers using adjustable-rate,

interest-only mortgages in an effort to make

high-priced homes more affordable.

Additionally, there is evidence of a weakening in

certain corners of the market. In the luxury market,

for instance, "what we're finding is that properties

that sold...in the first quarter of 2005 seem to be

on the market longer" in a number of locales, says

Stuart Siegel, president of Sotheby's International

Realty, a unit of

Cendant

Corp., blaming the "net impact of sticker shock."

There were signs last

fall that the housing market, at long last, was

beginning to soften in such places as Orange County,

Calif., and Boston. Real-estate brokers say business

picked up in many markets after a brief slowdown,

helped along by declining mortgage rates. In some

local markets, improving economic conditions have

played a role. In Atlanta, corporate relocations

plus a sense of increased job security have helped

boost sales of homes priced at more than $1 million,

says Chris Ballard, broker-owner of Century 21 Gold

Medal Realty.

In

some markets, such as Phoenix and Newport News, Va.,

real-estate brokers say sales are stronger this year

than last. In some cases, homes are flying off the

market within days or even hours of being listed.

Brokers in some markets say the rise in sales that

normally arrives with spring began earlier this

year. In

some markets, such as Phoenix and Newport News, Va.,

real-estate brokers say sales are stronger this year

than last. In some cases, homes are flying off the

market within days or even hours of being listed.

Brokers in some markets say the rise in sales that

normally arrives with spring began earlier this

year.

The likelihood of yet

another frenzied spring comes on top of record sales

last year. Fueled by low mortgage rates, sales of

existing homes hit 6.78 million, topping a record of

6.18 million in 2003, according to the National

Association of Realtors. Home prices climbed more

than 20% last year in Miami, Las Vegas, Phoenix, Los

Angeles and Washington, D.C., among other markets.

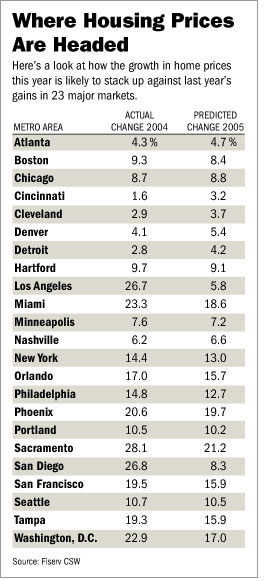

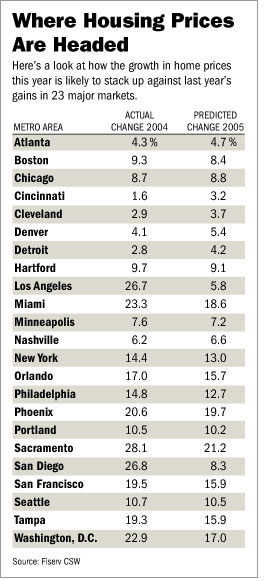

Economists generally

agree that price gains will slow to more normal

levels, though just when this will happen -- and how

deep the slowdown will be -- remains an open

question. Home-price research company Fiserv CSW

Inc. expects some slowing this year. It forecasts

that home prices will rise an average of 7% to 9%

this year, following last year's 14.3% rise, in the

90 major metropolitan areas it tracks.

Slowdown In Second

Half?

NAR chief economist

David Lereah expects a slowdown in the second half.

So far this year, he says, the number of homes sold

is running about flat compared with last year's

strong showing.

The strong housing

market "will continue as long as interest rates

remain relatively low and credit remains relatively

easy," says Kenneth Rosen, chairman of the Fisher

Center for Real Estate and Urban Economics at the

University of California at Berkeley. But, he adds,

"the longer the boom goes on, the bigger the

correction will be."

In Newport News, Va.,

"it's even more frenzied than it was last year,"

says Liz Moore, president of Liz Moore & Associates,

where sales rose 43% in the first quarter from the

year-earlier period. "If we have a reasonable

listing, we have multiple offers in the first couple

of days -- five to seven isn't unusual," she says.

The supply of

properties for sale is so thin in Manhattan,

meanwhile, that more buyers this year are offering

$100,000 or more above the listed price.

Arlyne Blitz, a vice

president with Corcoran Group, says one of her

clients recently made an all-cash offer that was

$155,000 over the asking price for a two-bedroom,

1,500 square-foot condo priced at $1.35 million in

an arrangement that required would-be buyers to

submit one "best and final" offer.

"We were No. 7 of 17,"

Ms. Blitz says. "The winning bid was for over $1.6

million." Some brokers there are deliberately

underpricing property to elicit greater bidding and

a higher final selling price, she notes.

Properties also are

flying off the market in Phoenix and Tucson, where

an influx of refugees from Southern California and

Las Vegas -- looking for lower-cost housing or

better investment opportunities -- is helping to

propel prices skyward. Last year, the average home

in the Phoenix area stayed on the market for 50 to

60 days, says Bill Jilbert, president of Coldwell

Banker Success Realty. Now, he says, "the pendulum

is so far to one side that it's not even fun."

Six

Hours, Eight Offers

Broker

Tom Weiskopf put his own 3,000-square-foot

four-bedroom home in Scottsdale, Ariz., on the

market in late February. Within six hours he had

eight offers, with most buyers waiving the standard

contingencies for financing, appraisal and

inspection.

Mr.

Weiskopf cut off the bidding at 7 p.m. and accepted

an offer for $645,500, $4,500 above the listed

price.

The

competition among buyers is especially fierce for

entry-level homes. In Long Beach, Calif., "anything

under $500,000 in a decent neighborhood is going to

produce multiple offers," says Richard F. Gaylord, a

broker with Re/Max Real Estate Specialists. Mr.

Gaylord last month received 29 offers on a

1,084-square-foot, three-bedroom starter home that

sold for $510,000, $60,500 more than the asking

price.

Russell

Garron, a pharmaceuticals salesman, initially

offered $455,000 this month for a 1,200-square foot,

three-bedroom condo in Irvine, Calif., listed at

$449,000.

Mr.

Garron upped his offer to $465,000 because there

were multiple bids. When his broker, Tamzi

Richardson of First Team Real Estate, called at

10:30 p.m. that night with the seller's response,

Mr. Garron immediately dashed to Kinko's to fax in

his paperwork. While searching for a home, "I slept

with my cellphone," says Mr. Garron, who lost out on

two other properties.

New Construction

Not

every market is as heated. In Kansas City, the

average time on the market climbed to 57 days in the

first quarter from 49 days during the same period

last year.

"We're

not seeing the rush of multiple offers...[or] sales

coming in well over the list price like we were

seeing last year or the year before," says Jerry

Reece, president of Reece & Nichols there.

In the

bellwether market of San Diego, home prices rose at

an annualized rate of 12.5% in March, down from as

much as 26.4% in October, according to DataQuick

Information Systems, which tracks U.S. real-estate

sales.

Houston

broker Julius F. Zatopek III, of Re/Max on the

Brazos, says sales have softened in that city in

recent weeks after spiking during the first quarter

as buyers dived into the market, nervous about

rising interest rates.

In

Miami, where sales remain strong, resale prices of

existing condos in the $500,000 to $900,000 price

range could fall by as much as $200,000 later this

year, predicts broker Mark Zilbert . With so many

new units coming onto the market, "the motivation is

to be in a hip new property," Mr. Zilbert says. With

existing units, "the value isn't there." |

Fisher Island

Fisher Island 360 Condo West

360 Condo West 360 Condo East

360 Condo East 360 Marina Condo West

360 Marina Condo West 360 Marina Condo East

360 Marina Condo East The Lexi

The Lexi Alison Island

Alison Island Central Miami Beach

Central Miami Beach Hibiscus Island

Hibiscus Island La Gorce Island

La Gorce Island Palm Island

Palm Island Pinetree

Pinetree South Beach

South Beach Star Island

Star Island Sunset Islands

Sunset Islands Venetian Islands

Venetian Islands West Miami Beach

West Miami Beach

In

some markets, such as Phoenix and Newport News, Va.,

real-estate brokers say sales are stronger this year

than last. In some cases, homes are flying off the

market within days or even hours of being listed.

Brokers in some markets say the rise in sales that

normally arrives with spring began earlier this

year.

In

some markets, such as Phoenix and Newport News, Va.,

real-estate brokers say sales are stronger this year

than last. In some cases, homes are flying off the

market within days or even hours of being listed.

Brokers in some markets say the rise in sales that

normally arrives with spring began earlier this

year.